From the Blog

10 Credit Hacks to Improve Your Credit & Buy A Home

Whether it’s your first time buying a home, or if you’re looking to buy and move, having good credit is a crucial part of the process. Good credit increases the likelihood of qualifying for a mortgage, which is an obvious roadblock for many people looking to purchase a home. There are other factors that determine your mortgage eligibility, like your income, but it’s important to keep your credit score as high as possible to make you more attractive to lenders.

Your credit score is complicated; it’s affected by many different things. That’s why we want to guide you through these 10 credit hacks that will help you boost your credit score to make buying a home easier and faster!

Understand what your credit score currently is

Many people might not know exactly what their credit score is, for a number of reasons. First off, they might not know where to look. Furthermore, they might not realize the importance of knowing it or what it really means. Let’s break down the basics.

Your credit score is a number between 300–850 that represents your ability to pay back money that you borrow. The higher the score, the better you look to other lenders. It’s based on credit history and things like the number of open accounts, total levels of debt, repayment history, and other factors.

Now that you know what your credit score is, you can find out where to check it. Softwares like Credit Karma or Mint are very helpful and help you understand what your credit score is. Plus, softwares like these often give you tips on how to improve it. These next tips are all related to actual practices that will help you raise your credit score once you’ve found out what it is.

Set up auto-pay for your bills

This may seem like something you want to do already, but it actually has a really positive effect on your credit score. By simply paying all your bills on time and consistently, you’ll avoid harmful credit reports that come from missed payments. Auto-pay options for your bills (if available) are quick, easy, and will benefit you without you really having to do anything.

Maintain 2-3 major credit cards

Maintaining multiple lines of credit through major credit cards is a great way to improve your credit score. In fact, only having one credit card or having too many credit cards hurts many people without them realizing it.

Increase your credit card limits

If you maintain your 2-3 credit cards with major lenders long enough, you’ll begin to have higher limits on them. Essentially, the lenders will trust you with more money over time, which translates to a higher credit score. To do this, keep paying your credit card bill in full each month, utilize about 30% of your credit limit at the most, and keep up with other good credit practices like the ones listed in this post.

Keep your credit utilization ratio low

As mentioned above, your credit card score is impacted by how much of your credit limit you actually use. This is called your credit utilization ratio. To improve your credit score and/or credit card limit, only use a maximum of 30% of your credit limit.

Transfer your balances to a new card

If your credit is good enough to transfer, you potentially could get a 0% interest rate for over 12 months to help you pay down your balances, have access to more credit, and even lower your credit utilization ratio. Essentially, you want to take your existing credit balance and move it to a card that has a higher limit, so your credit utilization ratio will appear lower without you having to adjust how much you spend.

However, there is a catch. You can’t continue to spend on the card from which you transferred the original balance. Your credit utilization ratio won’t go down if you keep spending. Also, keep in mind that you may be charged a 3-5% fee for transferring your balance.

Pay off loans

The faster you pay off your loans, the happier the lenders are, which means the higher your credit score is. If you let loans stack up, you inadvertently show lenders that you can’t be trusted with their money, so your credit score will fall as a result. Plus, paying off loans quicker means less money spent on interest. A win-win situation if you can do it!

Gauge your debt to income ratio

What is a debt to income ratio? It’s as simple as it sounds. It’s the amount of money you make vs. your financial commitments such as loans, other mortgages, etc. Obviously, if you make a lot more money than you have in outstanding debt, or vice-versa, you’ll appear as either credit-worthy or not credit-worthy to lenders.

To improve this ratio, try to pay down your existing debt and look for ways to increase your income if possible.

Close secured credit cards when you no longer need them

What is a secured credit card? It’s a card that’s backed by a cash deposit from the cardholder and can help reduce bad credit. In other words, the balance has already been paid, since the cash acts as collateral.

If you’ve used a secured credit card to improve your credit score, be sure to close it afterward. These are “stepping stones” that help you to improve your credit score; they’re not permanent things you should use.

Become an authorized user on someone else’s credit card account

If you’re looking to improve your credit score quickly, becoming an authorized user on another account is a way to do so. What does being an authorized user on another account mean? It means you’ll receive your own card with access to the same line of credit as the original account user, but you won’t be able to make changes such as applying for more credit or closing the card.

This will benefit your credit score if the original credit user’s account is in good standing, doesn’t have a high balance, and if you don’t rack up credit card debt on the account. Simply be responsible and make sure you pay for everything on time!

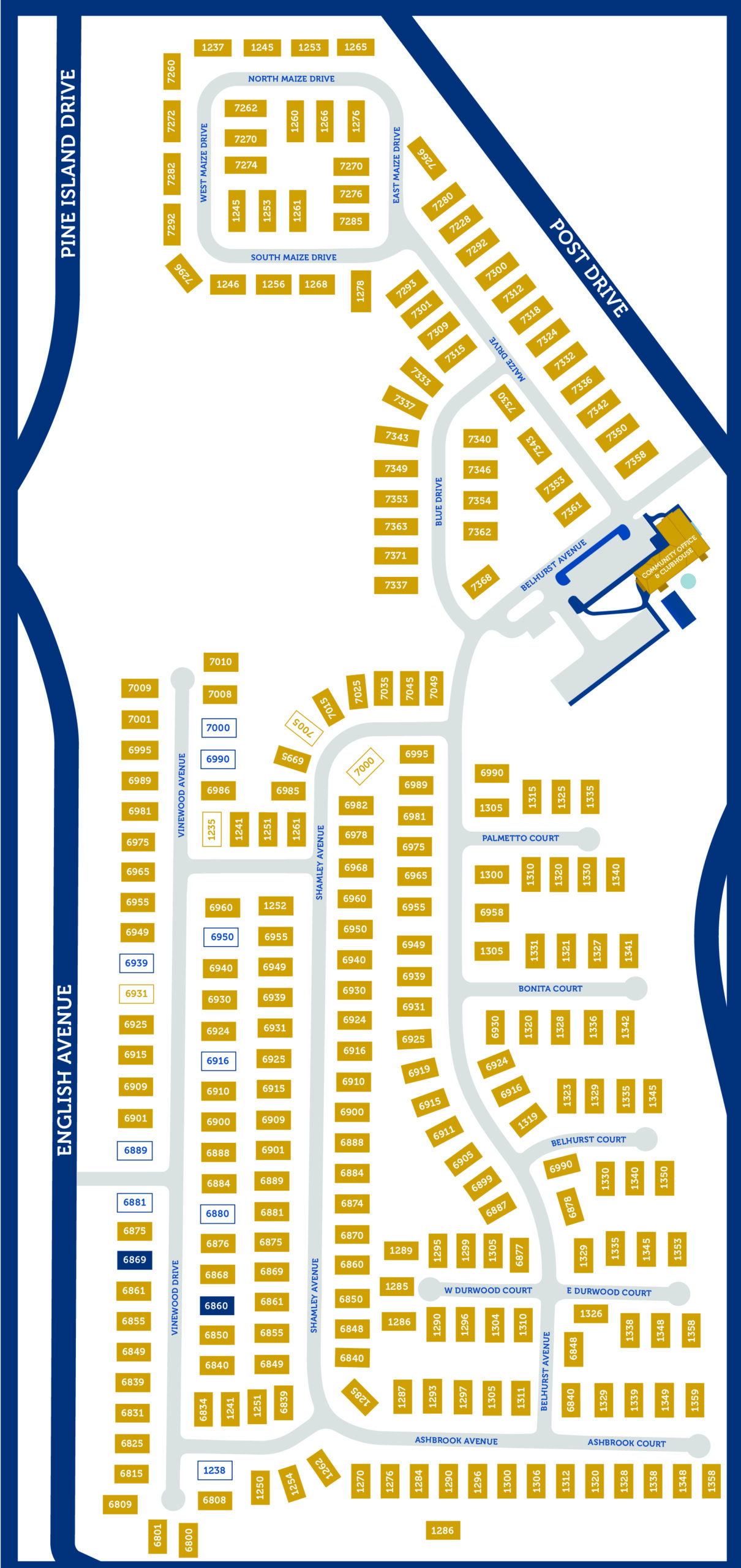

Buy a Home at Aspire Communities When You’re Ready!

When you’ve built your credit enough to be ready to buy a home, consider Aspire Communities! Our manufactured homes give you the freedom and independence of homeownership but at the price of an apartment.

When you choose to live with us, you choose to live in a community mindful of your needs, that’s eager to provide you with the companionship and respect you deserve.

Feel empowered to take control of your life in a home and community that supports you. Join the 2,000+ happy residents currently living in Aspire Communities’ welcoming neighborhoods.

Contact us today to learn more about available homes and see how we can help you find the right fit.

P.S. If you’re wondering if a manufactured home is a good option for you, make sure to read our blog post about how owning one can potentially be a great investment for you and your family.