From the Blog

Can I Buy a Manufactured Home With Bad Credit?

Your credit score does not define who you are, but it can feel like it defines the opportunities you have. In fact, over half of all Americans currently have subprime credit scores, so a lot of people are in the same boat.

Unfortunately, credit scores often stand in people’s way of getting some of the most important things we need in life, like a new home.

If you have bad credit and have ever tried applying for a new place to live, you know exactly how hard it can be.

Buying a site-built home, even a small one, can seem impossible and many landlords do credit checks on people who are interested in renting an apartment or a house from them.

What Does a Credit Score Represent?

A credit score is a number generated from activities in your credit history.

Some of these activities include:

- Total amount of debt

- Type of debt accounts (such as credit card, small purchase financing, personal loans, mortgage, leases, or medical bills)

- Timeliness of Payments Amount of time accounts have been open

- Percentage of credit being used on an account

Obvious things that will reduce your credit score are late payments, delinquent accounts, going beyond your credit limit, or foreclosure. On the other end, credit score boosters include timely payments and long-held accounts without default.

It’s important to note that while a credit score is a useful and well-known measurement for banks, that three-digit number does not give a full picture of someone’s ability to pay back a loan and banks don’t expect it to!

Loan Terms for a Low Credit Score

Credit scores do matter, but instead of being the difference between a loan approval or denial, your credit history typically affects what terms a loan will come with.

What are loan terms?

Loan terms are the conditions a lender puts on a loan such as how big the minimum down payment amount needs to be, how high or low the interest rate will be, and the length of time you have to pay back the loan.

A lender may ask for 5%, 10%, or even up to 35% down payment to feel like they will be covered if the lender stops paying.

The higher the down payment, the more a borrower is personally invested in the loan. You will also see higher interest rates on loans the higher the credit risk a person is because a lender will want to feel the risk of lending to a borrower is worthwhile.

The higher the interest rate, the higher the risk a lender is willing to take. The problem for us is the higher the interest, the higher the monthly loan payments and the higher the overall interest paid over the life of the loan.

Some people can make these terms work and some can’t, but the key point for you is, the better your credit score, the more likely you will have favorable terms meaning lower minimum down payments and lower interest paid to the bank.

Should You Fix Your Credit Score Before Buying a Manufactured Home?

If you are making a large rent payment every month, it is possible you could lower your monthly payments, even with a higher interest rate on your loan.

If that is the case, you may want to shop for a home and refinance when your credit score improves.

Or, if you have another kid on the way and you are out of room where you currently live, getting a manufactured home will allow you to have time to improve your credit score while still living in a home you enjoy.

If you are not in a rush to move and have $0 for a down payment, you may want to investigate how to improve your credit score first.

If you have no or little credit history and a small down payment, you may want to give yourself some more time to build your (good) credit history.

If you are looking to increase your credit score but don’t know where to start, check out some tips and tricks provided by our experts.

Buy A Home At Aspire Communities

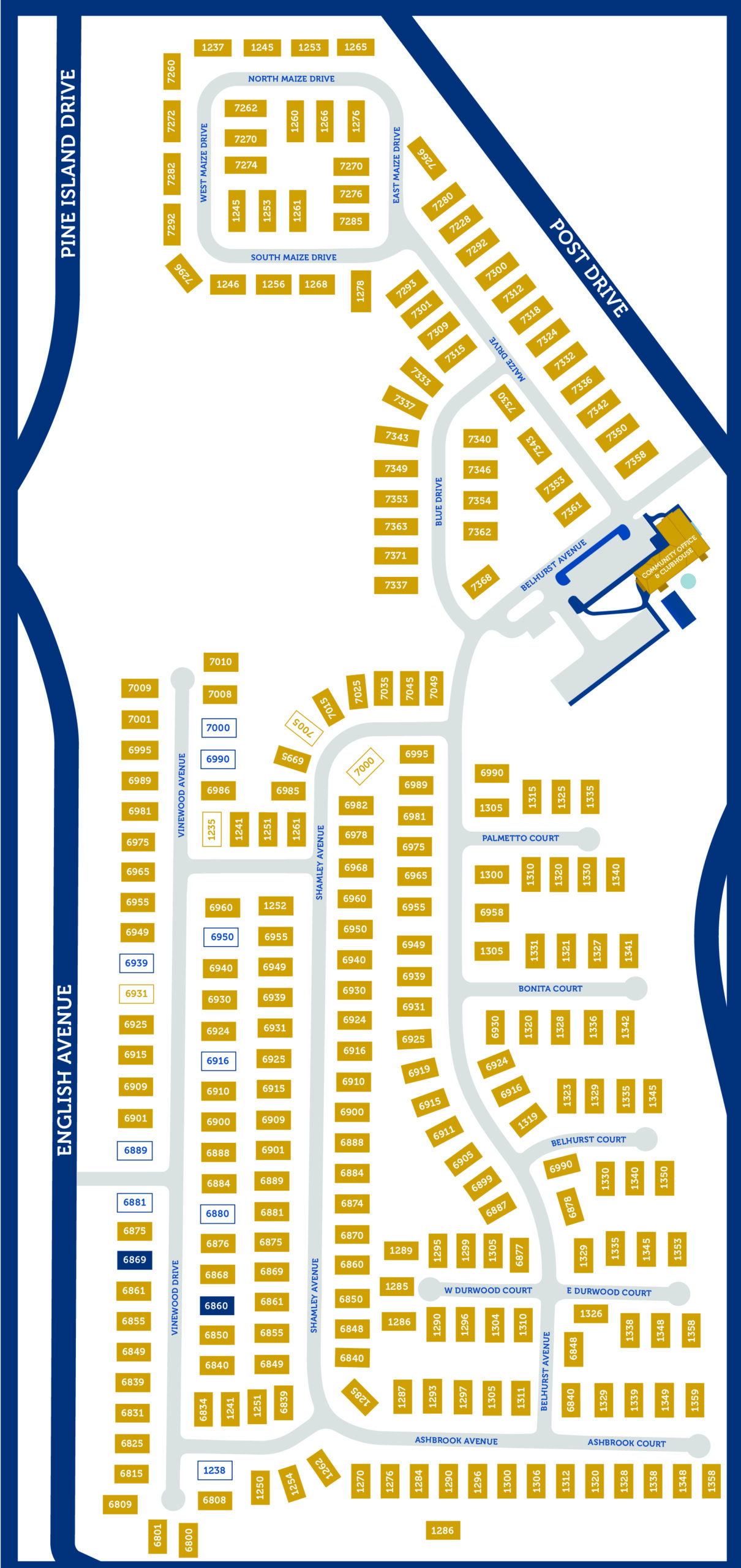

When you’ve built your credit enough to be ready to buy a home, consider Aspire Communities!

Our manufactured homes give you the freedom and independence of homeownership but at the price of an apartment.

When you choose to live with us, you choose to live in a community mindful of your needs, that’s eager to provide you with the companionship and respect you deserve.

Feel empowered to take control of your life in a home and community that supports you. Join the 2,000+ happy residents currently living in Aspire Communities’ welcoming neighborhoods.

Contact us today to learn more about available homes and see how we can help you find the right fit.

P.S. If you’re wondering if a manufactured home is a good option for you, make sure to read our blog post about how owning one can potentially be a great investment for you and your family.

Want to improve your credit score? Here are 10 Hacks to Improve Your Credit Score and Buy a Home!